Recently, a consumer posted a concerning update about a significant change to Stenograph’s license transfer fees, which have more than doubled from $1,400 to $3,400. For those unaware, Stenograph is a company that provides software and equipment for the stenographic profession, and its Case CAT software is widely used by court reporters. This price hike has led some to question whether the company’s actions are in violation of fair business practices, especially considering the impact on retiring professionals looking to sell their software to newcomers.

The Price Hike and Its Implications

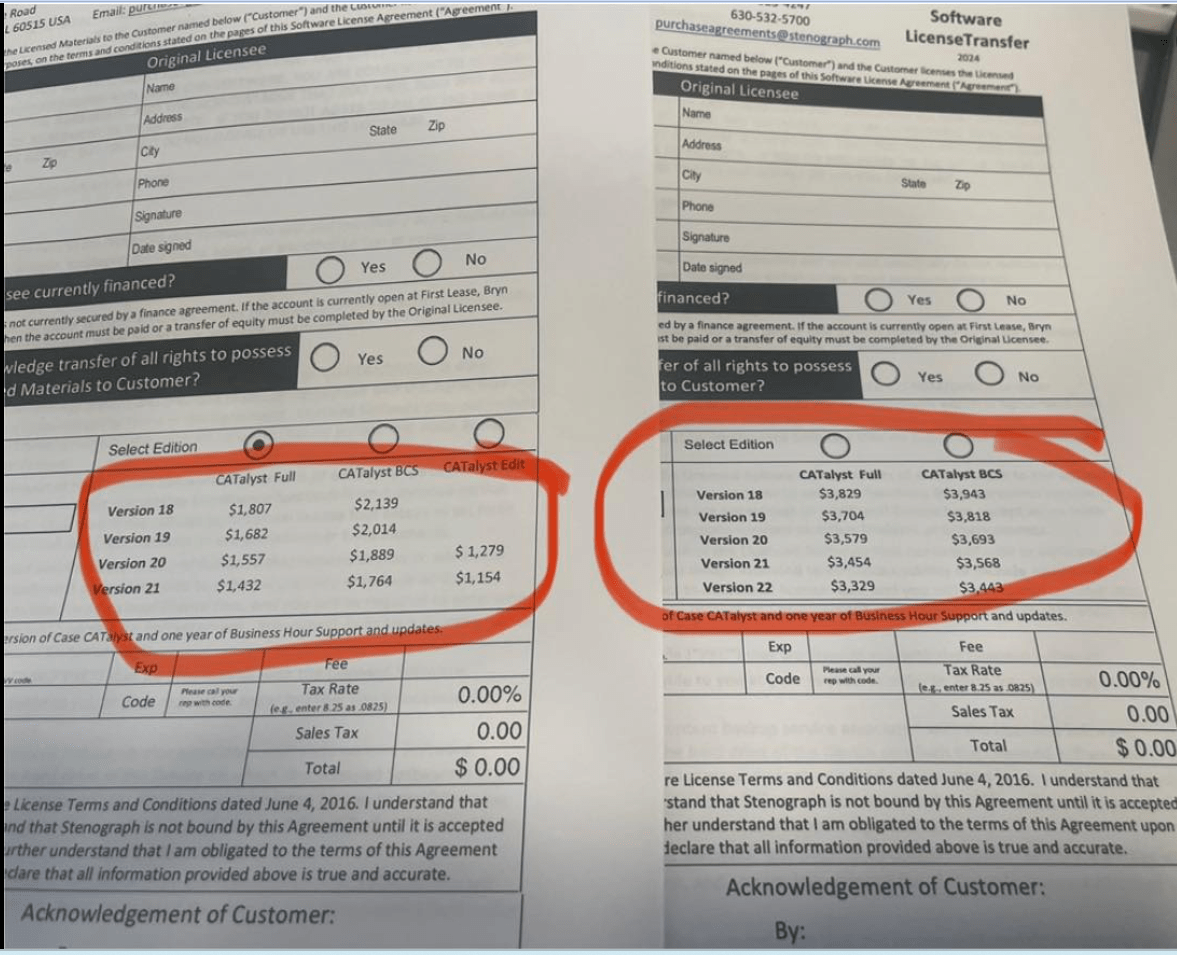

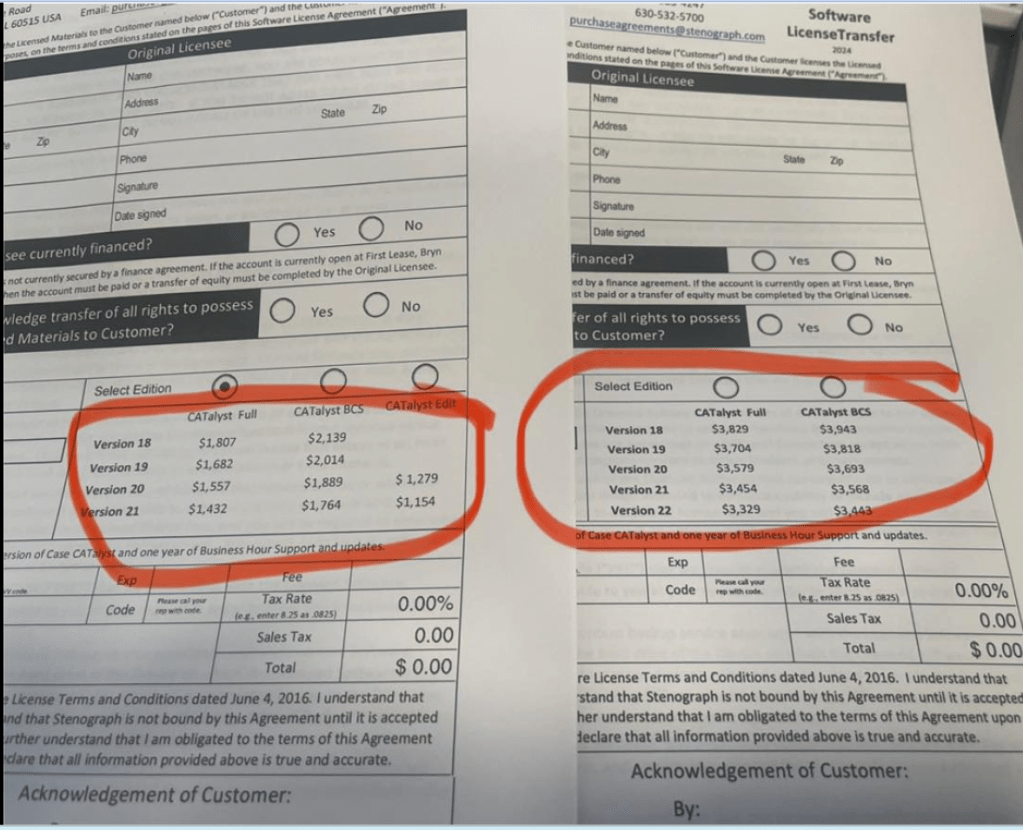

A year ago, this consumer had contemplated selling their Case CAT software but opted not to at the time due to the $1,400 license transfer fee. However, upon revisiting the decision recently, the consumer was shocked to discover that the fee had risen to a staggering $3,400. The individual had always maintained their support contract with Stenograph for peace of mind and the most recent updates, with the intention of selling the software to help a new reporter get started. Now, with the new fees, that option seems much less viable.

For many, this change raises a red flag. Not only does it seem to effectively price out retiring reporters looking to help newcomers in the field, but it also appears to position the transfer fee on par with the cost of buying the software directly from Stenograph. This drastic increase has left consumers feeling betrayed, as the company’s actions are viewed as reducing opportunities for independent sellers and potentially even stifling the competition.

Antitrust Violations: Is Stenograph Engaged in Anti-Competitive Behavior?

The stark increase in the transfer fee is more than just a consumer grievance—it raises questions about Stenograph’s market dominance and the potential for antitrust violations. The case bears resemblance to historical antitrust cases, such as the infamous Ticketmaster case, where the company was accused of monopolizing ticket sales. In the case of Stenograph, consumers may wonder whether the company is engaging in monopolistic practices that restrict competition and unfairly inflate prices for those reliant on their products.

Let’s break this down.

Monopolization and Market Power

One key factor in any antitrust lawsuit is proving that a company has a dominant share of the market in question. In the case of Stenograph, if the company controls a significant portion of the stenographic software and hardware market, it could be considered a monopoly. This dominance is crucial in determining whether the company’s actions have unfairly restricted competition. If Stenograph has the power to set prices without fear of competitors undercutting them, their price hike could be seen as a strategic move to capitalize on their market control.

Exclusionary Practices

Exclusionary practices occur when a company engages in behavior that limits competitors’ ability to operate in the market. This can include high switching costs, exclusive contracts, or price-fixing. If Stenograph has implemented restrictive practices such as discouraging competition through high fees for selling or transferring their software, they could be setting up a scenario where new or independent players in the field are unable to compete with Stenograph’s pricing and products.

In this case, the increased transfer fees could be seen as a tool to deter retirees from selling their software, thereby reducing the market supply of secondhand licenses and keeping the prices inflated. If Stenograph is refusing to allow competitors to offer viable alternatives, this could further strengthen claims of anti-competitive conduct.

Consumer Harm

One of the most important considerations in any antitrust case is whether consumers have suffered direct harm due to anti-competitive behavior. In this case, the increase in fees directly impacts court reporters, particularly those nearing retirement, who may rely on selling their software to recoup some of their investment. If this price hike forces them to either sell at a loss or abandon the idea altogether, it could be argued that Stenograph is unfairly exploiting their market position to the detriment of consumers. This kind of harm is key in proving that Stenograph’s actions are anti-competitive.

Legal Implications: Could Stenograph Face a Lawsuit?

Consumers and competitors could potentially file a lawsuit under antitrust laws, such as the Sherman Act or the Clayton Act, if they can demonstrate that Stenograph’s practices constitute monopolization or an unreasonable restraint of trade. The Sherman Act, in particular, prohibits monopolistic practices, while the Clayton Act addresses activities that may harm competition, such as exclusive contracts or price-fixing.

If Stenograph were found guilty of violating these laws, they could face a range of legal remedies, including treble damages (three times the actual damages suffered), attorney’s fees, and even a formal investigation by the Department of Justice (DOJ). These actions could lead to a settlement, as was the case in the Ticketmaster-Live Nation merger, where the DOJ required the company to license its software to competitors and prohibited retaliatory actions against venues using competing services.

What Does This Mean for Consumers?

For consumers, this development could lead to significant financial harm if the price hikes continue to outpace the ability of individuals to transfer their licenses at reasonable rates. Those considering retirement or selling their software may find themselves stuck between the financial burden of Stenograph’s fees and the potential for legal action.

If a significant number of consumers are affected by these price hikes, it could prompt a class-action lawsuit or an investigation into the company’s practices. Reporting these grievances to the Federal Trade Commission (FTC) or the Department of Justice (DOJ) could also encourage further scrutiny of Stenograph’s actions and possibly lead to regulatory changes.

At the heart of this issue lies the balance between business interests and consumer welfare. While companies have a right to set their prices, they must also be mindful of how their pricing practices impact the competitive landscape and the people who rely on their products. If Stenograph’s fee hikes are found to restrict competition or harm consumers, there may be serious legal consequences, and the company could face scrutiny akin to what Ticketmaster experienced in its antitrust cases. For now, consumers are left to question whether these practices are in line with fair business conduct or if they are the first steps toward anti-competitive behavior that could affect the entire stenographic industry.